Finance Structure

Project finance is the lending structure that has financed a great many of the massive infrastructure and sovereign projects in emerging market countries throughout the world.

We deliver project finance solutions on a world scale along with an inexorable commitment to make every client deal more profitable.

Global Trade Services provides the international project financing you need along with deal structuring advisory services that mitigate risk and aggressively protects your interests.

With more than two decades of senior underwriting experience at some of the world’s biggest banks, our directors give us unparalleled underwriting expertise coupled with the strength derived from having many of the world’s top lenders and financial institutions as strategic partners. From that foundation, we develop some of the most innovative project funding solutions in the world and source unique project funding alternatives through capital markets and lenders worldwide. We also enhance your project with the capabilities of a global funding team with a history of successfully funding some of the most challenging and complex international financing projects in the world.

Our expertise in delivering successful project financing packages and our innate ability to match the right project with the right lenders, architects, engineers, consultants, builders, developers and all of the professionals your project will need is uncanny. Doing it seamlessly and at the right time gives us all the tools we need to arrange and deliver extraordinary financial solutions for challenging, difficult-to-place loans and projects.

Sustainability in international project financing means delivering at the most difficult of times. By exploiting our strengths and core expertise in project finance we are often successful at placing project development loans for clients whose financing has been declined by other financiers and lenders. If your project has been turned down, we can help. We’ll pre-underwrite your project financing to see if we can successfully fund your project where others have failed. Submit a Request for Project Financing now and we’ll get your financing started today.

Project finance is the lending structure that has financed a great many of the massive infrastructure and sovereign projects in emerging market countries throughout the world.

Contact us or submit our simple Project funding online application today to get started and achieve your financial goals.

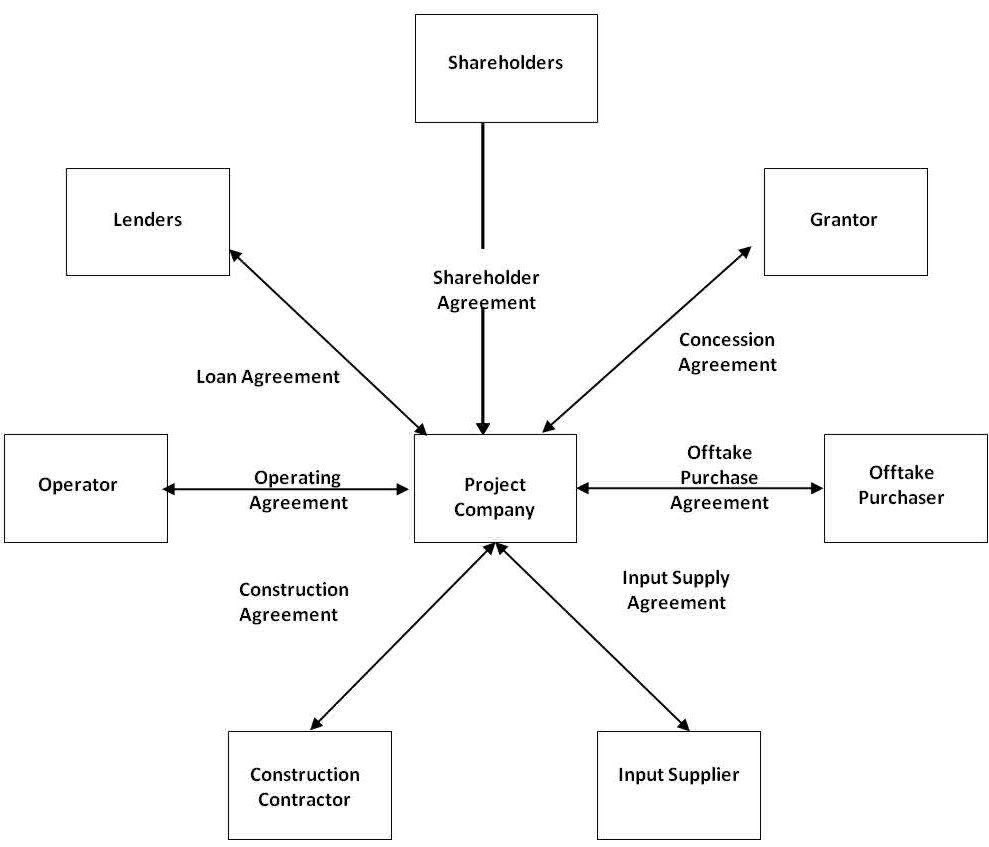

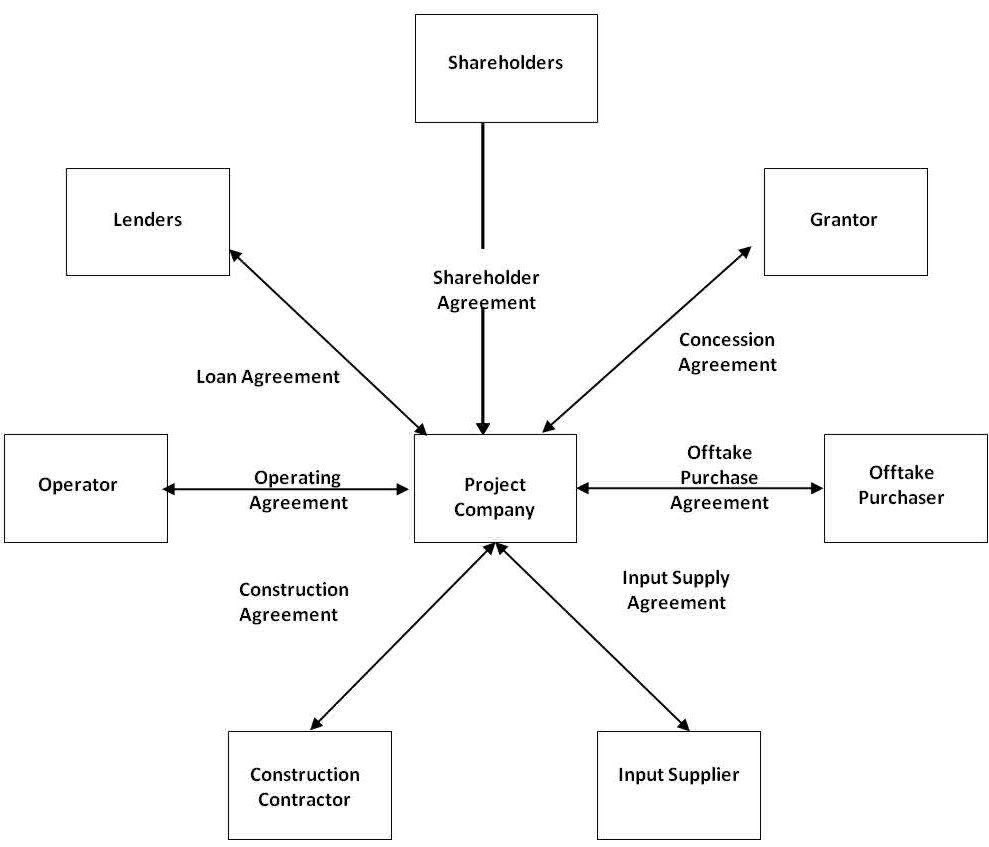

Our Project funding agreements and other key documents are documented via a compilation of the various mutual promises

Once you have decided to apply for Project funding and the application has been filled out and you have provided us with the necessary information.They will be verified

When your application is submitted in full then due dilligence will be carried out to evaluate while you wait for approval.

Project Finance provides long-term, limited recourse or non-recourse loans used to finance large commercial, industrial, infrastructure and sovereign projects in emerging market nations worldwide.

Unique to project financing is the debt and repayment structure are based on the projected cash flow of the project rather than the balance sheets of the project sponsor. Usually, a project finance structure involves a number of equity participants, who can be project sponsors or equity investors, and a consortium of lenders that provide loans to the project.

Project finance loans are almost always extended on a non-recourse or limited recourse basis and are secured by the project assets and operations. Repayment of the loans occurs entirely from project cash flow, not from the assets or credit of the borrower. Underwriting for project development loans focuses on what is usually a business plan that includes extensive financial modeling and sensitivity analysis. The financing is typically secured by all of the project assets, including the revenue-generating components of the project. Lenders are granted a lien on all of the project assets and are further granted the right to assume managerial and operational control of a project, along with the mechanism to do so if the project doesn’t comply with the loan terms.

The borrower is typically a Special Purpose Entity or SPE which is created in the project documents specifically to own the project. The SPE ownership structure coupled with non-recourse debt effectively shields the assets of both the project sponsor and equity investors from collection efforts or deficiency actions if the project fails.

With collection actions barred if the deal fails, project lenders often require a commitment from the project owners to contribute capital to the project to ensure the project is sufficiently capitalized and financially sound, and also to demonstrate the project sponsors’ commitment to the deal. Project finance is significantly more complex than traditional corporate finance or real estate lending. Historically international project finance has been used for mining, telecom, transportation and communication, water and electric utility distribution, and major public infrastructure projects.

Allocation of the risk stack among project participants is a key component of project finance. Project developments are often subject to technical, environmental, economic and political risks, particularly in developing countries and frontier and emerging markets. If the lenders or project sponsors determine that the risk exposure is too great during underwriting, the project is rendered unfinanceable.

Long-term contracts for construction, supply, off-take, operations and concessions, along with contracts establishing joint-ownership of the project are structured in extensive project documentation to best align the interests and incentives of all the project participants. They are also designed to dissuade bad behavior on the part of the deal participants. In this way, project risk is allocated amongst the deal participants who are best able to manage the risk.

The amounts involved in project development financing are often so vast that no single lender could or should provide the entirety of the project financing. Instead, the project financing is often syndicated to a consortium of lenders to distribute the risk.

Project financing was used as far back as the ancient Greeks and Romans to finance maritime voyages. It was project finance that funded construction of the Panama Canal and the North Sea oil wells.

Today, most project financing is deployed in developing countries around the world where the need for project financing remains high and will for the foreseeable future. As more countries move from frontier to emerging economies demand for public utilities and infrastructure will continue to increase.